Invoice Factoring to facilitate your immediate business needs *

Invoice factoring helps small businesses by converting invoices to immediate cash advances.

What Is Invoice Factoring?

Advance Amount*

Start at $20,000 and range up to $10 million

Easy Application

Apply and submit your outstanding invoices

Simple Process

Get immediate access to capital on outstanding 30, 60, or 90-day invoices

Invoice factoring is a type of financing where a business sells its invoices at a discounted price for immediate access to working capital. It can take anywhere from 30 to 90 days for most businesses to receive payments from their customers, in these cases, invoice factoring gives small businesses quick access to funds to meet their cash flow needs. The funder will receive payments on invoices directly from your customers, or you will forward your customer’s payments to the funder until the entire advance amount is paid off.

One of the advantages of invoice factoring is that it allows your business to turn outstanding invoices into upfront working capital. An important thing to note about invoice factoring is that most funders will review a business’s outstanding invoices to make sure customers have a history of making payments on time.

Rapid Finance works closely with many funders that offer simple solutions to obtaining funds through invoice factoring.

Invoice Factoring Allows For Immediate Access to Capital From Your Outstanding Business Invoices

You’ll only need 2 important things to apply.

A valid form of identification

Unpaid invoices from a reputable creditor

Application Process

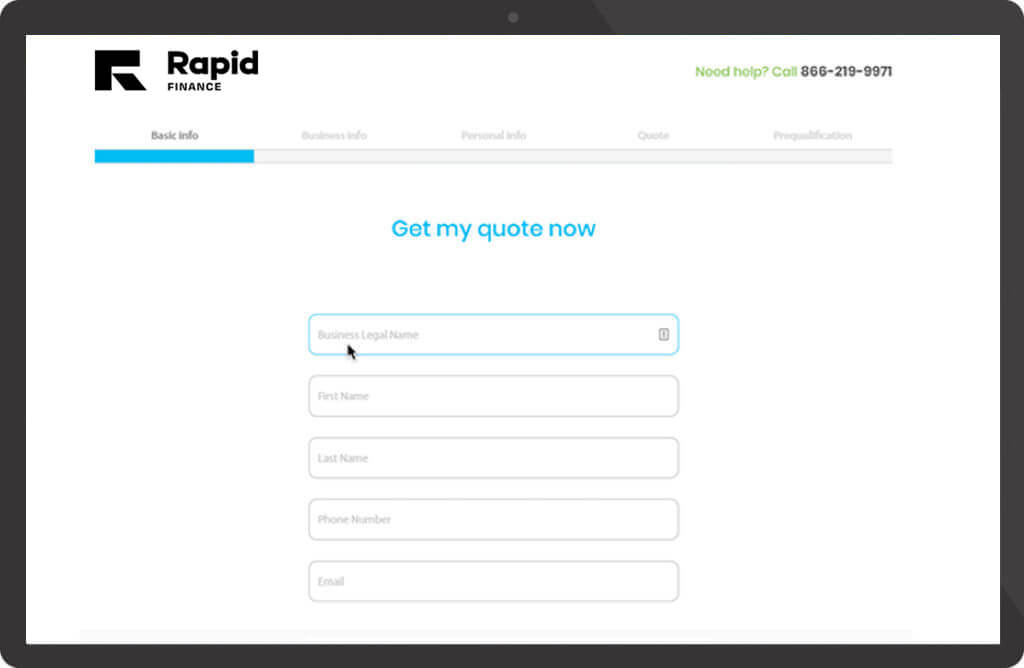

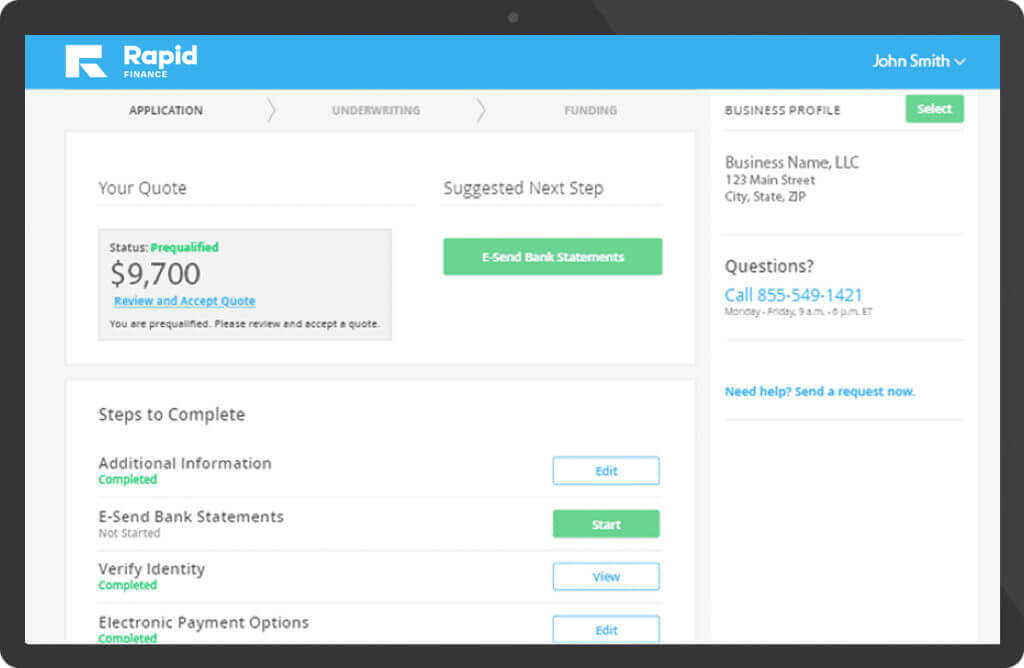

Visit our online portal to fill out an application. Tell us about your company, goals, and objectives. We recommend having the necessary paperwork on hand to make the process even faster.

Our team and our funding partners will carefully review all the information provided. One of our trusted business advisors will reach out if we need any additional information.

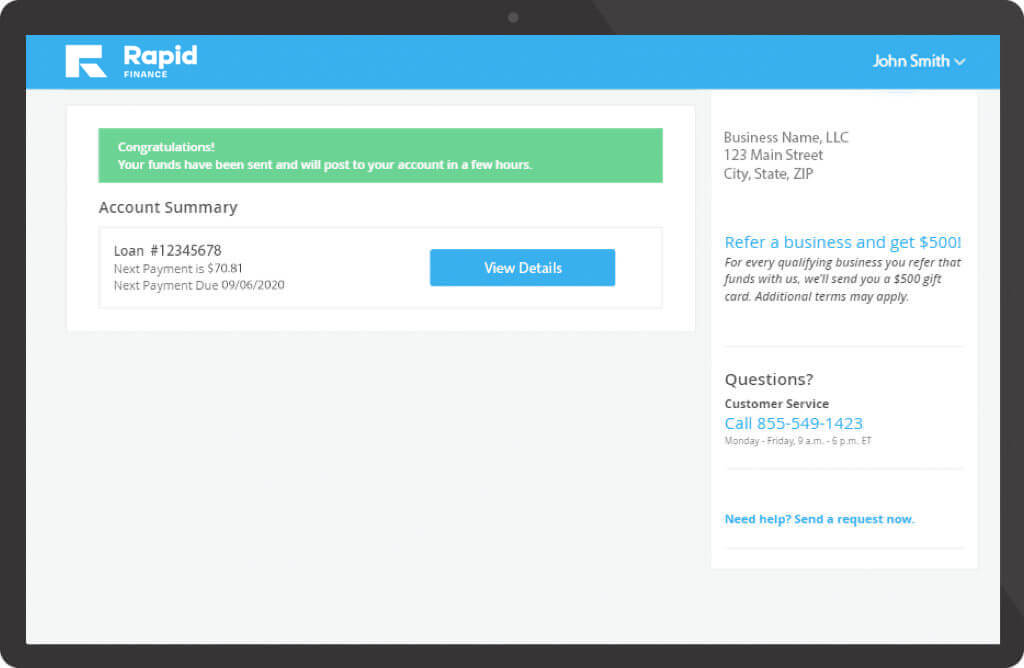

Your business will receive the funds in your business bank account if approved.

Invoice Factoring FAQs

Invoice factoring is a type of short-term funding that allows your business to convert its business invoices into working capital. Funders will purchase a business’s outstanding invoices at a discounted rate and provide them with fast access to working capital. The funder will then continue to collect payments from the invoices purchased.

This type of financing is ideal for businesses that do not receive payments for their products or services immediately but rather receive payment on their invoices in 30, 60, or 90-day terms.

The answer varies as there are many factors funders will take into consideration to approve a business other than just credit history. However, most funders are more focused on the outstanding invoices (and the payment history of those customers) versus the business’s credit history. The reason being is that the funder will collect the payments on the outstanding invoices once they purchase the invoices from the business. Not every funder works this way, so it may vary based on who purchases your invoices.

Ensure you’re selling invoices that have a history of timely customer payments. This will give you a higher chance of being approved.

Invoice factoring gives you quick access to working capital and improves cash flow. Plus, approval for invoice factoring is usually more flexible and easier to apply for. Businesses can take advantage of being able to improve cash flow by creating better relationships with their customers, as invoice factoring allows them to provide customers with longer payment terms.

Every funder has different requirements that must be met. As a general rule, most funders require that businesses sell to other businesses, have customers that have a history of making payments on time, are located and operate in the United States, and have invoices that pay on 30, 60, or 90-day terms.

Yes. Invoice factoring is a type of accounts receivable factoring.

Financing With Rapid Finance

At Rapid Finance, we’re dedicated to finding custom financing solutions for our small business clients. It’s simple, your business is our business. We provide you with all the resources you need to unlock big potential for your small business.

- Trusted by over 30 thousand small businesses around the country

- Simple application process

- Team of talented business advisors dedicated to providing your business with quick and reliable funding information

- A streamlined process for additional funding needs