Commercial Real Estate Loans help secure the property your business needs

Commercial real estate loans facilitate long-term growth by securing the property your business needs.*

What Is a Commercial Real Estate Loan?

Loan Amount*

Start at $75,000 and range up to $2 million

Loan Terms*

Range from 5 years up to 20 years

Payment Frequency*

Automatic monthly payments from an account on file

Commercial real estate loans are ideal for businesses looking to purchase, develop, or construct new property as well as current property. Businesses can apply for a commercial real estate loan/mortgage, which is secured by liens on the commercial property. As the name states, this is for commercial properties only and not for residential properties. The terms and rates differ from a traditional residential mortgage.

Uses for commercial real estate loans can vary, meaning businesses don’t have to acquire new property to apply. This loan can cover expenses such as refinancing or renovations on current business real estate in addition to covering new real estate property. Keep in mind, this type of financing is very different from a traditional residential mortgage that you would apply for when purchasing or refinancing residential property.

Commercial Real Estate Loans Help Small Businesses Facilitate Their Property Needs

You only need 3 important documents to apply.

A valid form of identification

Two years of tax returns or financials

Schedule of debts

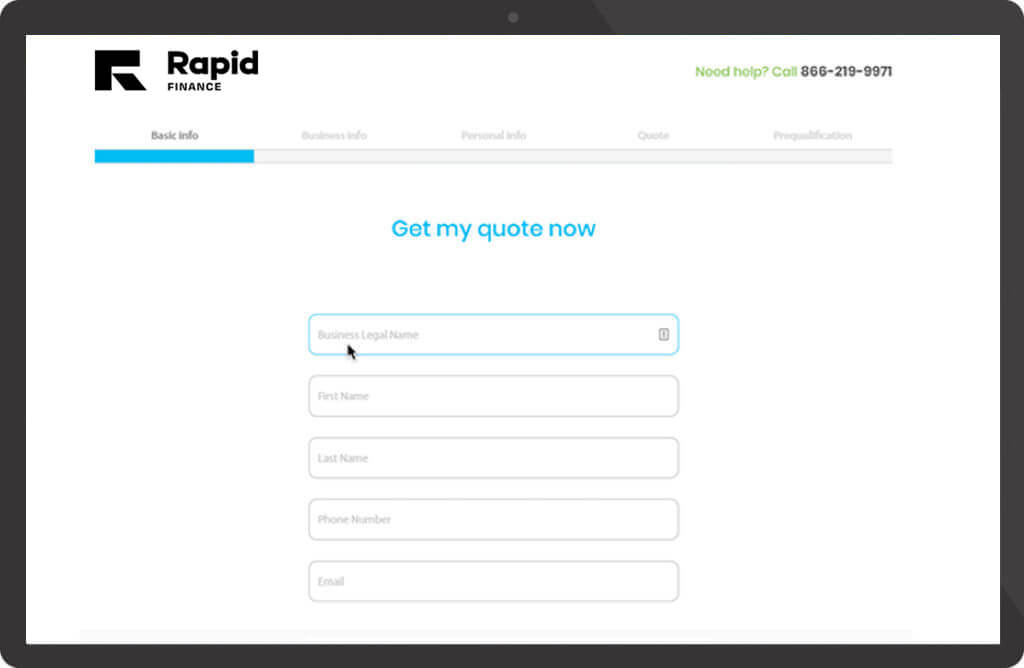

Application Process

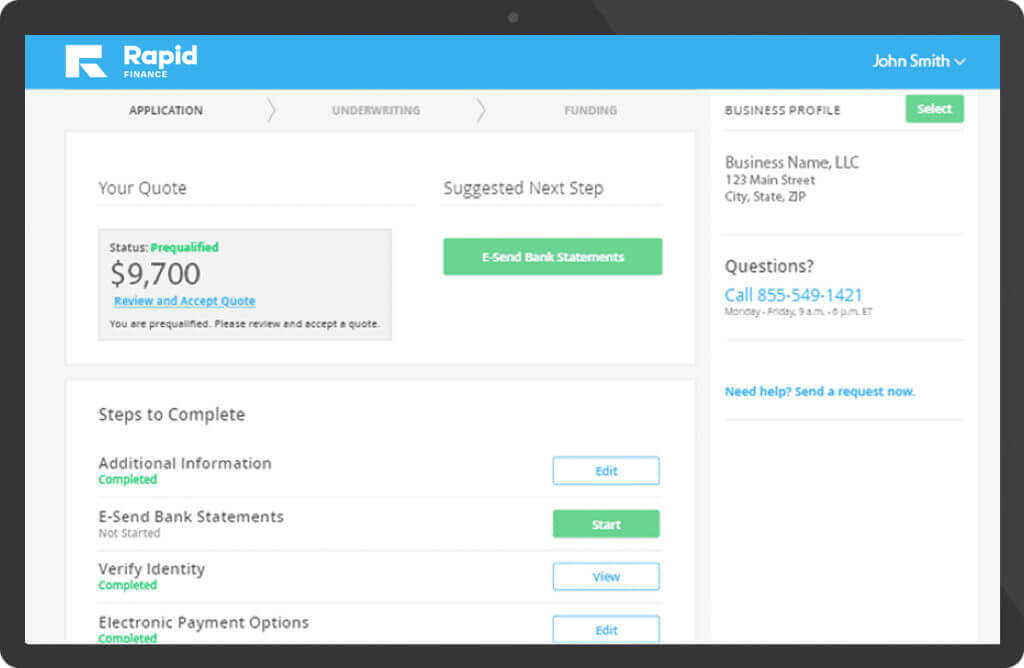

Visit our online portal to fill out an application. Tell us about your company, goals, and objectives. We recommend having the necessary paperwork on hand to make the process even faster.

Our team and our funding partners will carefully review all the information provided. One of our trusted business advisors will reach out if we need any additional information.

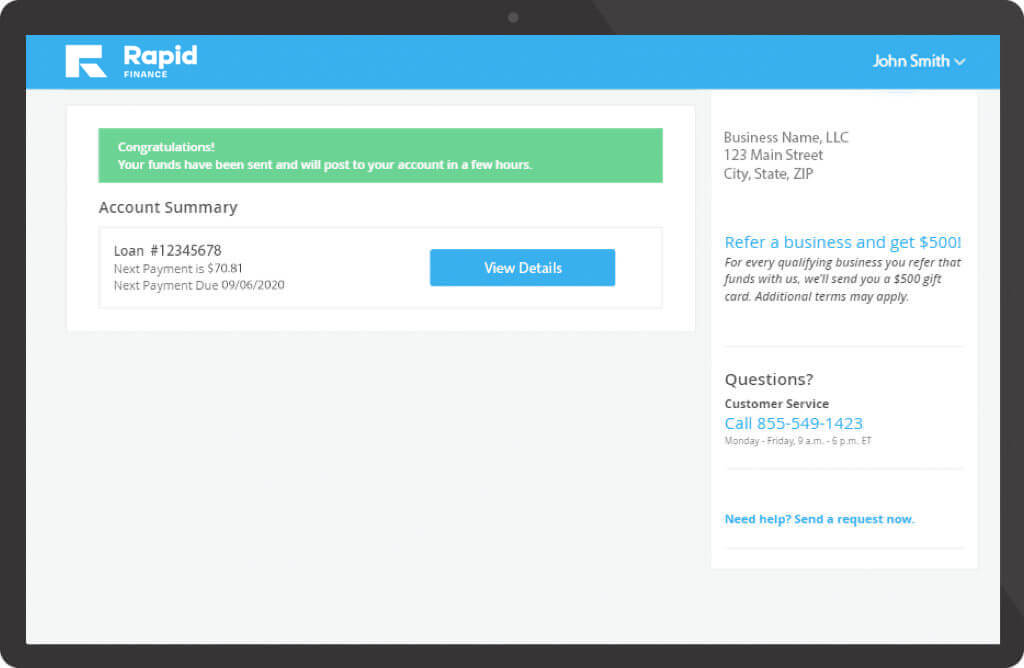

Your business will receive the funds in the account on file if approved.

Commercial Real Estate Loans FAQs

Commercial real estate loans work by granting businesses the working capital needed to purchase a new commercial property, refinance, or work on renovations for current commercial real estate. The loan is a mortgage secured by liens on the commercial property. Lenders will take into consideration the loan-to-value ratios, which means the process for getting approved varies greatly from a traditional residential mortgage.

Any company that has the intention of purchasing a new commercial property, renovating a current commercial property, or refinancing a commercial mortgage should consider applying for a commercial real estate loan.

A commercial real estate loan makes sense for your company if you intend to use the working capital for commercial real estate. This type of loan will not work for primary or secondary residential residences. In addition, interest and repayment terms vary greatly from a residential mortgage.

Requirements vary depending on the lender and type of loan your business is looking to apply for. As a general rule, lenders will take into consideration your business financial statements, your company’s debt service coverage ratio, property characteristics such as property use and value, and percentage of expected/current occupancy.

Rates depend on the lender the business works with and the type of loan you’re looking to apply for to secure a mortgage. As mentioned, these rates are very different from a traditional residential mortgage loan, so please consider this before applying.

Commercial Financing With Rapid Finance

At Rapid Finance, our team is dedicated to finding the perfect financing solution for your small business. With fast, simple, and secure funding when you need it most, we’re trusted by over 30 thousand businesses nationally.

- Funded over 3 billion to businesses all over the country

- Online portal designed to help meet your business’ needs

- Team of talented business advisors dedicated to providing your business with quick and reliable funding information

- A streamlined process for additional funding needs