Asset-Based Loans turn your business assets into immediate funds

Asset-based lending uses your business assets as collateral to cover short-term cash flow demands.*

What Are Asset-Based Loans?

Loan Amount*

Start at $50,000 and range up to $10 million

Loan Terms*

Range from 6 months up to 36 months

Payment Frequency*

Daily, weekly, or monthly fixed payments

Asset-based loans give small businesses access to working capital through an agreement that’s secured by business collateral such as inventory, accounts receivable, equipment, or other property owned by the borrower. This means the lender is collateralized with an asset of the business. It’s important to note that the more liquid the business asset, the less risky the loan. An asset-based loan is a secured business loan that can be less risky and have bigger benefits than unsecured loans, including potentially lower rates.

Since businesses an asset-based loan is secured through collateral, lenders base their funds on the value of the secured assets. The financing available may vary from lender to lender and depends on the type of collateral the business has.

Asset-Based Loans Use Business Assets as Collateral for Immediate Working Capital

You only need 2 important documents to apply.

A valid form of identification

Last three months of business bank statements

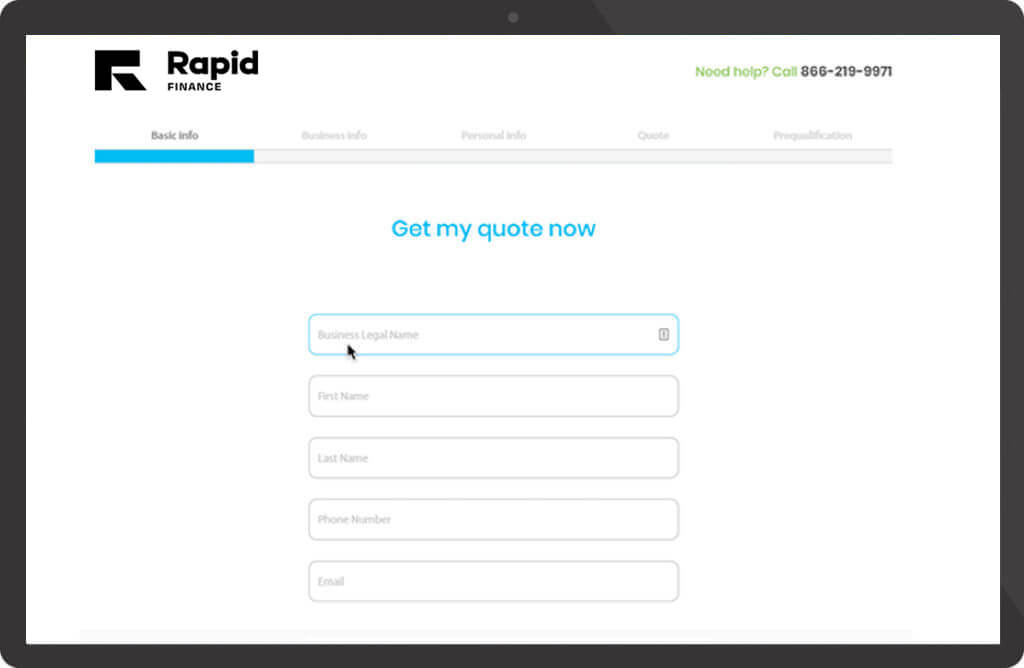

Application Process

Visit our online portal to fill out an application. Tell us about your company, goals, and objectives. We recommend having the necessary paperwork on hand to make the process even faster.

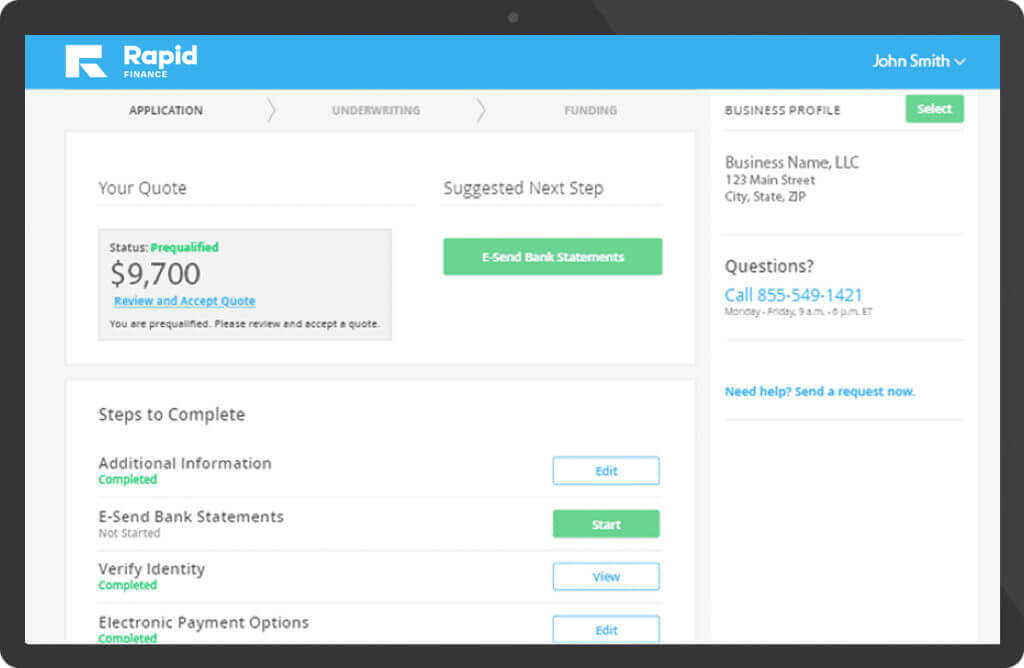

Our team and our funding partners will carefully review all the information provided. One of our trusted business advisors will reach out if we need any additional information.

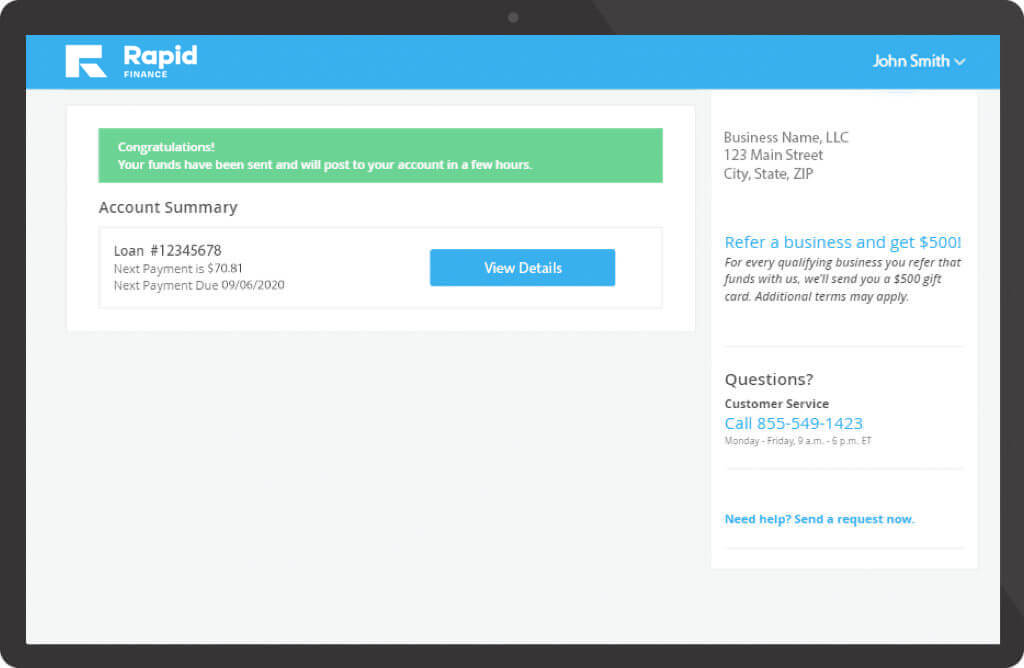

Your business will receive the funds in your business bank account if approved.

Asset-Based Loans FAQs

Asset-based loans work by granting businesses access to working capital through a secured loan using business assets. Most lenders use the loan-to-value ratio to determine the amount of money they’re willing to approve based on the number of business assets.

In the event of a default on an asset-based loan, the lender may be able to take or sell the asset to pay off the remaining balance.

Any business with a valid form of identification and 3 months of bank statements can apply for asset-based lending. If the business has a good history of financial statements, commonly sold inventory, and reputable clients, among other things, they have a better chance of securing an asset-based loan. Manufacturers, distributors, and service companies are usually best suited as they have seasonal business needs that require immediate access to working capital and have the assets to secure a loan.

Because businesses applying for an asset-based loan are using their business assets as collateral to obtain financing, the loan is considered less risky by the lender. The lower the risk, the better the benefits offered. In most cases, asset-based loans also allow for lower rates.

Assets are business collateral that is used to secure financing whose value is equal to or similar in value to the loan amount needed. Accounts receivables, equipment, real estate property, and business bank accounts are the most common type of assets used, however, there are additional types of collateral that lenders may accept.

Requirements vary by lender. As a general rule, most lenders provide asset-based loans to businesses that are considered stable. This is shown through past business bank statements and payments on prior financing. Lenders also look for a larger amount of assets that can be used as collateral for the loan.

The types of business assets vary by lender. However, as a common rule, assets that are taken into consideration include accounts receivable, inventory, marketable securities, and property, among others.

Commercial Financing With Rapid Finance

At Rapid Finance, we’re trusted by over 30 thousand businesses to secure them with fast, simple, and trusted financing. We’re committed to the long-term growth of your business, which is why we’ve gathered all the business financing resources your company needs to succeed.

- Funded over $3 billion to businesses all over the country

- Online portal designed to help meet your business’ exact needs

- Team of talented business advisors dedicated to providing your business with quick and reliable funding information

- A streamlined process for additional funding needs