Spending Freedom: The Truth About Small Business Financing

It’s hard to qualify for a traditional small business loan through a bank, and it’s even more difficult to get funding through a Small Business

It’s hard to qualify for a traditional small business loan through a bank, and it’s even more difficult to get funding through a Small Business

If you’re a small business owner, your need for cash is often greatest in the period before you receive payments. The long-term health of your

The process of getting a traditional bank loan for your small business is frustrating. It’s nearly impossible to get a banker’s attention if you have

If you’ve been thinking of expanding your business, now is the perfect time. A record number of business owners reported that they planned to expand

As a small business, keeping your head above water and planning for growth can be a delicate balance. There’s a certain truth to the saying

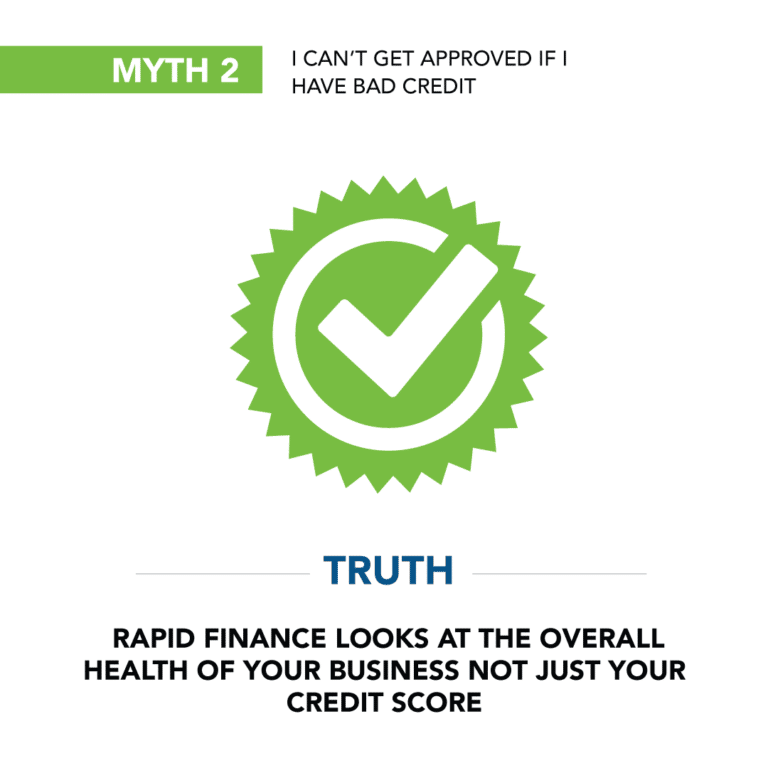

Applying for a business loan can be a tense time, and especially if you’re just starting out. If you haven’t had a chance to build a solid credit record, or you have concerns about your current credit file, you may not rate your chances with the bank. And it’s true that many banks and traditional lenders will want to see at least two years of promising business operations or a decent amount of collateral before they will even consider you for an SBA-backed loan, because they see you as too much of a risk.

Credit cards offer many benefits, but it’s difficult to qualify for one if you have bad credit. One of the reasons that lenders shy away

Your marketing campaign puts your restaurant on the road to long-term success, develops repeating customers, and builds awareness for your restaurant. Consider these ideas when you’re putting together a marketing strategy for your restaurant.

Rate hikes have been all over the news lately, but what does it mean for your small business? The increase from 0.5 to 0.75 percent was picked by the Federal Reserve with the country’s economic growth rate and inflation rates in mind. They’ve only adjusted the rates once since 2008, so this move is getting a lot of attention. What’s more, there’s a good chance these rates could go up even further in June.

Many small business owners view a sudden surge in their growth rate as a great situation. They enjoy widespread brand awareness, see an increasing number of orders come in and have an immediate boost in cash flow. If you’re caught off-guard by increased demand, small business growth can turn into a damaging force for your company. You need to have a strategy to handle this occurrence before it happens.